Capital Market

Are you sure you have what it takes to reach your financial objectives? To succeed, one needs a strong understanding of investment strategy in addition to diligence and self-control. Your financial future shouldn’t be treated lightly; after all, it matters. This proves to be harder than it seems for many people.

Even the most intelligent people may find the financial world’s complexity intimidating. Any investor can benefit from having a solid understanding of the fundamentals of investing. A good place to start is by comprehending the function of capital markets in the financial environment.

Capital Markets: What Are They?

The transfer of wealth from those who have accumulated it to those who require it to be productive can be accomplished through capital markets. The stock market is among the most prevalent illustrations of a capital market. Stocks in companies that require finance might be purchased by investors who want to increase their capital. In theory, the company that receives the investor’s money and uses it wisely should increase the investor’s wealth.

The stock exchange and the bond market are examples of capital markets. Additional divisions into primary and secondary marketplaces are possible. Capital markets are designed for the issuance and trading of long-term securities, as opposed to the short-term equities purchased and sold in capital markets.

Different Types Of Capital Markets

Capital markets can take on a variety of shapes and sizes. Capital markets that trade in equities include stock exchanges like the New York Stock Exchange, NASDAQ, and London Stock Exchange. Commodities are traded on the Chicago Mercantile Exchange, a capital market. The capital market kinds that are most prevalent include:

On a stock exchange, investors typically exchange money for holding a company's shares. The business gets this money in return to use for operations and internal growth.

hareholders will lend money to a company in the bond market in return for a guarantee to repay the debt plus interest.

Shareholders purchase agreements for raw materials and finished products on the currency market in consideration of the pledge to pay the potential value of such products.

In a forex market, investors will trade money with other individuals and organizations looking for spendable funds in a particular market, such as dollars, euros, and pounds.

Capital Markets

A Boon To Your Financial Health

The exchange of stocks, bonds, money, and commodities is made possible through capital markets, usually referred to as financial markets. They are available in primary and secondary varieties. While the latter facilitates trading among investors rather than between investors and the entities that generated the securities, the former facilitates trades between entities that create assets and purchasers, often big or institutional buyers.

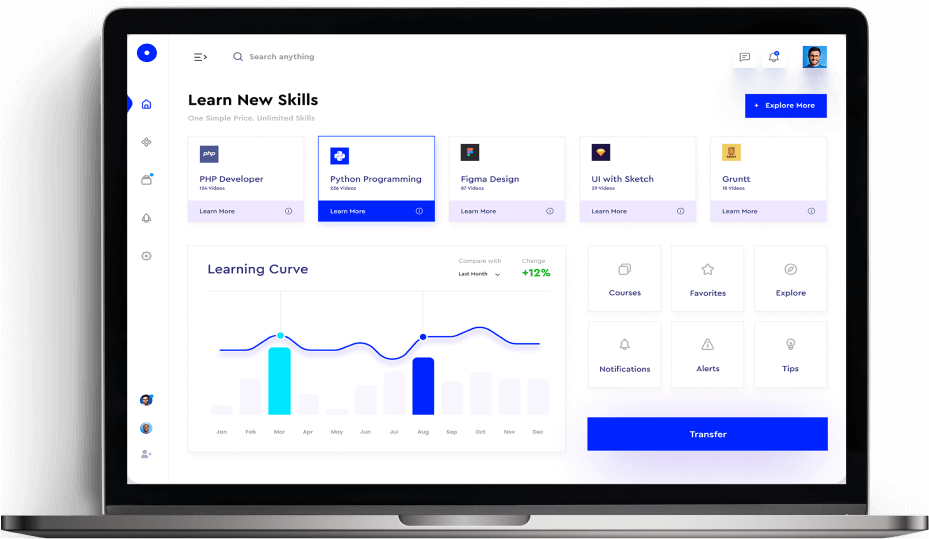

Consult an experienced financial counselor like Share Giants to learn more about the different secondary capital markets investment options. It need not be difficult to find the ideal financial advisor who meets your demands. The free application from Share Giants matches you with our best financial experts in five minutes. Get started right now if you’re prepared to be matched with our experts who can assist you in reaching your financial objectives.

We care about safety big time — and so do your site's visitors. With a Shared Hosting account, you get an SSL certificate for free to add to your site. In this day and age, having an SSL for your site is a no-brainer best practice. Not only does an SSL help your visitors feel safe interacting with your site — this is particularly important if you run an e-commerce site.

We care about safety big time — and so do your site's visitors. With a Shared Hosting account, you get an SSL certificate for free to add to your site. In this day and age, having an SSL for your site is a no-brainer best practice. Not only does an SSL help your visitors feel safe interacting with your site — this is particularly important if you run an e-commerce site.

We care about safety big time — and so do your site's visitors. With a Shared Hosting account, you get an SSL certificate for free to add to your site. In this day and age, having an SSL for your site is a no-brainer best practice. Not only does an SSL help your visitors feel safe interacting with your site — this is particularly important if you run an e-commerce site.